SFDR Disclosure

Introduction

Sustainability risk management is embedded in the way Maguar Capital seeks to originate investments and make investment decisions, as well as in ongoing portfolio and asset management activities.

Maguar Capital recognises the importance of identifying, assessing and managing material sustainability risks as an integral part of conducting business.

Maguar Capital’s sustainability risk policy (also ESG Policy) provides a comprehensive framework for integrating sustainability risk management into investment decision making.

How does this Sustainability Risk Policy work?

The Sustainability Risk Policy sets out how sustainability risks are integrated into Maguar Capital’s investment decision-making processes.

The Sustainability Risk Policy applies for Maguar Capital’s entire investment cycle. In particular, the deal-team shall use this policy as main point of consideration within the deal-flow process from sourcing to completion. In addition, Maguar places high importance on the policy in the ongoing portfolio monitoring for existing investments. Lastly, the investment committee takes into consideration the sustainability risk factors when deciding over the exit of an investment.

Our policy considers the main sustainability risk factors related to Environmental, Social, and Governance. Within each of the categories we identify relevant sub-categories relevant to our operations and to targeted industries in which we invest. The following non-exhaustive list of sustainability risks are considered: climate change resilience, pollution, biodiversity, carbon emissions, human rights in supply chains, health and safety, community relations, cultural heritage, labour and employment practices, resource efficiency, and the materiality of each risk will be determined for each investment.

Integration of sustainability risks into investment decision-making processes

Sustainability risks are considered at all stages of each product’s investment process, in respect of each individual investment opportunity.

Once a potential investment has been identified, it should be determined whether such potential investment accords with Sustainability Risk Policy. During the preliminary meetings of the investment committee, key issued should be raised. After the investment is deemed compliant, an in-depth assessment of sustainability risks is undertaken during the due diligence process.

The investment team is required to complete a summary ESG questionnaire as part of the investment committee paper submitted to the Investment Committee for consideration. This ESG Questionnaire is a tool used to assess initial sustainability risks for a number of chosen areas relevant to the investment in question, and to identify where additional investigation or due diligence into sustainability risks is required. This seeks to ensure sustainability risks are identified and mitigated during the investment process.

The sustainability risk matrix requires completion of due diligence questionnaires by the deal team and requires an assessment of each deal to be conducted two times throughout the investment process: at Preliminary Investment Approval, and at Final Investment Approval. Where the potential investment operates in a complex industry or sensitive environment, Maguar Capital will consider engaging external specialist. The report includes a scoring of the risks which were identified during sourcing and due-diligence and a rating between Low, Medium, and High is given. Furthermore a short narrative is used as comment on each area.

Governance

Within Maguar Capital, the Compliance officer is responsible for the oversight of the sustainability and ESG risks. All Members of Maguar Capital are required to comply and operate under the internal ESG policies. As the firm growth of size in terms of employees and assets under management, further roles such as Sustainability Officer and ESG committee are planned to be implemented.

No consideration of adverse impacts

The SFDR requires Maguar Capital to make a “comply or explain” decision whether to consider the principal adverse impacts (“PAIs“) of its investment decisions on sustainability factors, in accordance with a specific regime outlined in SFDR. Maguar Capital has opted not to comply with that regime, both generally and in relation to the Fund.

Maguar Capital will keep its decision not to comply with the PAI regime under regular review.

Maguar Capital has carefully evaluated the requirements of the PAI regime in Article 4 of the SFDR, and in the draft Regulatory Technical Standards which were published in April 2020 (the “PAI regime“). Maguar Capital is supportive of the policy aims of the PAI regime, to improve transparency to clients, investors and the market, as to how financial market participants integrate consideration of the adverse impacts of investment decisions on sustainability factors. However, Maguar Capital is concerned about the lack of readily available data to comply with many of the reporting requirements of the PAI regime, as Maguar Capital believes that companies and market data providers are not yet ready to make available all necessary data for the PAI regime.

Notwithstanding Maguar Capital’s decision not to comply with the PAI regime, Maguar Capital has implemented positive ESG-related initiatives and policies, as part of its overall commitment to ESG matters, as summarised in this section. For the avoidance of doubt, none of the following information is intended to suggest that Maguar Capital complies with the PAI regime.

Remuneration policy

Maguar Capital (along with its subsidiaries and controlled affiliates, “Maguar Capital”) has established a remuneration policy (the “Policy“) applicable to all Maguar Capital entities. The Policy is developed, approved, implemented and monitored by a series of bodies within the Maguar Capital structure. The Policy applies to all employees of Maguar Capital, save for limited exceptions.

The Policy has been developed with the aim of supporting Maguar Capital’s business strategy, corporate values and long‐term interests, including by facilitating the identification, assessment and management of sustainability risks when determining individual remuneration packages. The key principles of the Policy include fostering appropriate risk culture (including with respect to the management of actual and potential conflicts of interest) and compliance with applicable law and regulations.

The performance management and rewards framework envisioned by the Policy has been designed to promote effective risk management, including in particular by:

- Ensuring that assessment of performance takes full account of adherence to risk management requirements, covering all relevant types of current and future risks, including sustainability risks;

- Implementing deferral arrangements using co‐investment and carried interest arrangements for senior personnel, facilitating alignment of interests between staff‐members and third-party investors. If the value of the relevant underlying investment portfolio should decrease (whether arising as a result of a sustainability risk or otherwise), the value of the employee’s holdings will be reduced accordingly; and

- Providing for reduction of deferred variable remuneration awards to senior personnel in certain circumstances, such as in the event that the entity in which the relevant employee works suffers a significant failure of risk management, or experiences a significant downturn in its financial performance (as determined in the sole discretion of Maguar Capital), including in connection with a sustainability risk concerning an investment.

The Maguar Capital Fund II GmbH & Co. KG (the Fund)

Sustainability-related disclosures

I. Summary

The Fund managed by Maguar Capital Management GmbH (Maguar GP), intends to promote environmental and social characteristics and consider the adverse impact of its investment decisions on certain sustainability factors across portfolio companies. The Fund will continue their focus by investing in B2B software and technology companies in the DACH region.

II. No sustainable investment objectives

The Fund will promote E/S characteristics (Article 8 SFDR), but will not make any sustainable investments (Article 9 SFDR) as its objective.

III. Environmental or Social Characteristics of the Fund

The Fund promotes environmental and social characteristics through the incorporation of ESG considerations within its investment processes.

Environment: Climate change, pollution, waste management, resource management, footprint in the supply chain, usage of energy for the technological infrastructure.

Social: Employee well-being, health and safety, supply chain, and human rights, product integrity, safety, and quality, community impact, employee diversity, and data protection and cybersecurity.

Governance: Business ethics, code of conduct, board and management structure, internal controls, supply chain governance, stakeholder engagement, and reporting.

IV. Investment Strategy

Maguar will continue its successful strategy into the second generation (the Fund) which is centered around the business of identifying, negotiating, executing, monitoring, and realizing equity-related investments in businesses. The Fund’s strategy focuses on small and mid-size software, software-based services, and technology platform companies with a particular focus on the DACH Region.

Maguar believes that sustainable business practices are well-matched with fund-level performance. ESG aspects are anchored in the investment process through the implementation of Maguar’s internal ESG Policy, which is in line with the requirements and recommendations of established industry standards such as the United Nations Principles of Responsible Investment (UN PRI).

The Fund will not invest, guarantee or otherwise provide financial or other support, directly or indirectly to companies or other entities that generate meaningful sales out of the direct involvement in:

- Tobacco, alcoholic products, weapons, ammunition, gambling, casinos, pornography, illegal activities, property holding, asset stripping, genetically modified organism (GMOs), or related sectors.

V. Proportion of Investments

The Fund does not commit to making sustainable investments with an environmental objective aligned with the EU Taxonomy, and will therefore not commit to a minimum extent to make sustainable investments.

VI. Methodologies for Environmental or Social Characteristics

Any investment for the Fund will undergo an ESG due diligence guided by Maguar’s internal ESG policy, particularly by its ESG due diligence checklist.

The following areas will be assessed:

- Available internal policies and measures of awareness for ESG topics

- Implemented reporting/monitoring processes

- Recent ESG incidents and reaction to them

- Supplier selection, interactions, and continuous assessment

- Data protection guidelines, processes, incidents

- Cybersecurity status quo, monitoring procedures

- Guidelines for using open source software, monitoring processes

VII. Monitoring of Environmental or Social Characteristics / Asset Allocation

The Fund portfolio is intended to have the potential to contribute positively to addressing climate change and/or to assist in the transition to a “net zero” economy. Investments may include sustainable investments within the meaning of the SFDR, however, there will be no minimum allocation of sustainable investments.

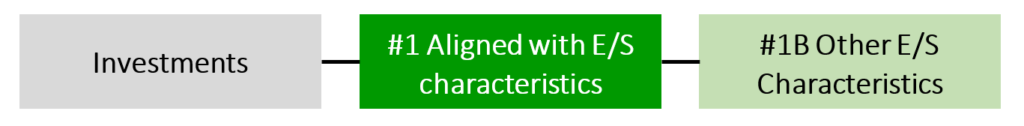

‘#1 Aligned with E/S characteristics’ includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

Category #1 Aligned with E/S characteristics covers the sub-category #1B Other E/S characteristics cover investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

VIII. Limitations to Methodologies and Data

The EU Taxonomy sets out a “do not significant harm” principle by which Taxonomy-aligned investments should not significantly harm EU Taxonomy objectives and is accompanied by specific EU criteria. The “do no significant harm” principle applies to those investments underlying the Fund and which take into account the EU criteria for environmentally sustainable economic activities.

The Fund’s investment strategy focuses predominantly on majority buyout investments, however, the Fund participating as a minority stakeholder for some portfolio companies could occur. As a minority stakeholder, the legal limitations would not allow the Fund to guarantee full compliance with all requirements outlined by the SFDR and the EU Taxonomy for sustainable investments with an environmental objective aligned with the EU Taxonomy.

IX. Due Diligence

Sustainability is anchored in Maguar through Maguar’s internal ESG policy. ESG aspects are considered throughout the entire investment lifecycle, including the due diligence phase for all new acquisitions. Maguar requires its deal teams to include ESG screening analysis in investment memoranda when seeking final Investment Committee approval. In addition to due diligence screening, ongoing ESG monitoring, and regular communication between the Maguar GP and the portfolio companies, Maguar GP does not conduct further research or investigations regularly, at least as long as the data reported by the portfolio companies do not give rise to any reasonable doubts.